Choose I-9 HQ™ to Help You Meet the Physical Inspection Requirements

- Up to three admin users

- Easy & quick set-up

- Mobile friendly I-9s

- Guided form completion

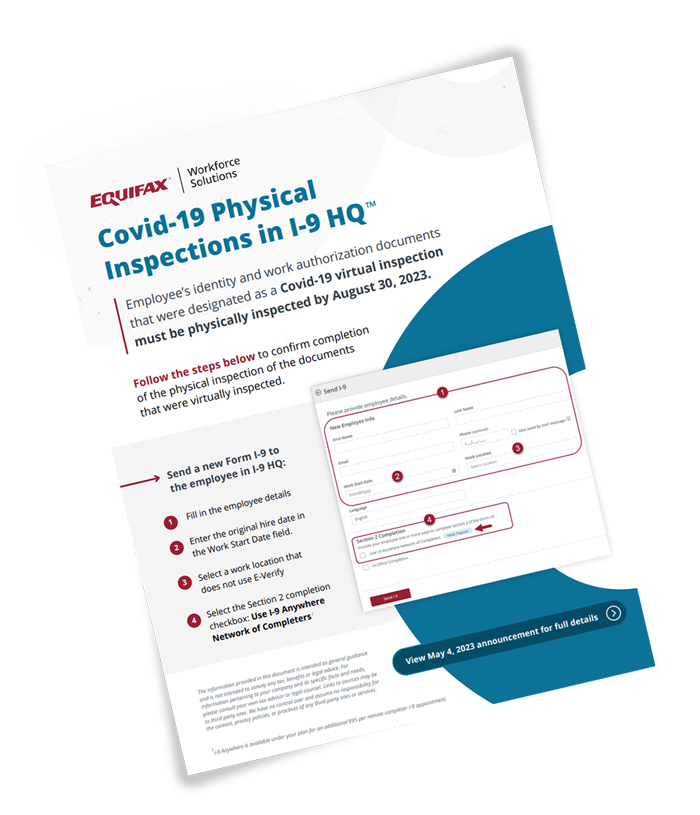

- I-9 Anywhere® trained Section 2 Completers1

- On-demand in-app training

- Reverification management

- In-app alerts & notifications

- Centralized & private storage

- Compliance Reports & dashboards

Access I-9 Anywhere

in I-9 HQ

With I-9 HQ, you can use I-9 Anywhere and tap into our network of trained I-9 Section 2 completers to help meet the physical inspection deadline.

Learn How to Use I-9 HQ to Complete the Physical Documentation Inspection Requirement

Commonly Asked Questions About I-9 Physical Inspections.

U.S. Immigration and Customs Enforcement (ICE) may treat the lack of an in-person document verification and attestation as a substantive violation, which can incur a fine of $272 to $2,701 per form according to the latest federal guidelines for civil monetary penalties. In addition the United States Citizenship and Immigration Services noted that “an employer cannot retain an employee who the employer knows is not authorized to work in the United States or that does not fulfill Form I-9 documentary requirements. This includes presenting documentation for in-person physical examination.

No, employers must only conduct physical inspections of I-9 documents that were “virtually” inspected during the pandemic through video, email, fax, or secure upload. If you used an in-person authorized representative process when you completed the I-9 OR you have already met in-person with your employee to review documents after the fact, then you DO NOT need to conduct another physical inspection by August 30, 2023.

A physical in-person inspection involves the reviewer examining the I-9 documents presented by the employee in person to determine if they appear to be genuine and relate to the employee presenting them. This is the same “review process” that an employer typically completes when completing Section 2 for a new hire or Section 3 for a reverification per the Form I-9 instructions. If the physical inspection for a new hire is being conducted by a different individual (which is often the case), ICE has specifically noted that the employer should complete a new Section 2, which would involve the reviewer entering all of the document information into Section 2 and signing the form.

Employers should consider drafting a communication plan to notify impacted employees of the need for a physical I-9 document inspection. In doing so, employers should explain the process, the timelines, and also provide a point of contact if questions arise.

If a new I-9 is completed, the employer should keep/retain both the original virtual I-9 and the follow-up physical inspection I-9 together. Having both I-9s will help explain why the second I-9 was completed at a much later date.

Lastly, the new I-9 typically should not be submitted to E-Verify (assuming that the individual was previously submitted when the virtual I-9 was completed).

1. Additional fees may apply. Transactions for I-9 Anywhere® have a fee of $95 per appointment.

The information provided in this document is intended as general guidance and is not intended to convey any tax, benefits, or legal advice. For information pertaining to your company and its specific facts and needs, please consult your own tax advisor or legal counsel. Links to sources may be to third party sites. We have no control and assume no responsibility for the content, privacy policies, or practices of any third party sites or services.